Medicare will pay part of the costs of prescription drug coverage for everyone who enrolls in a plan. How much you pay will depend on which prescription drug plan you choose and whether or not you qualify for Extra Help which helps cover the costs of this coverage.

Medicare Part D Deductible

Remember a plan with a deductible will not pay for your prescriptions until you pay the deductible amount out-of-pocket. The highest deductible a plan can charge in 2021 is $445. Some plans offer $0 deductible and will pay for your prescriptions right away. Other plans may offer a deductible lower than the maximum of $445 such as $150 or $250. You will generally only want to choose a plan with a $0 deductible if it also has the lowest overall cost per year, including the costs for the drugs you take.

Copayments and Coinsurance

A copayment, or copay, is a fixed dollar amount for your prescriptions. For example, you might have to pay $5 for a generic drug, $25 for a "preferred" brand name drug and $40 for a non-preferred brand name drug.

A coinsurance is a percentage of the price of your prescription. Typically plans require coinsurance for drugs listed in higher tiers like tier 4 and tier 5 drugs. For example, if your prescription costs $350, and your coinsurance is 25%, you will pay $87.50.

It is possible that some of your medications require a fixed copayment and others a coinsurance. Be sure to check the cost of each medication you take with the plan.

You will generally only want to select a plan with low copays or coinsurance if it also has the lowest overall annual cost per year, including the costs for the drugs you take.

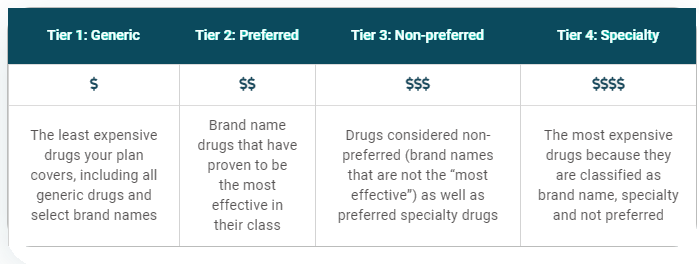

What are copay tiers?

Each plan places the drugs it will pay for in different levels, called tiers. Each tier has its own copay or coinsurance amount. Your drugs may be included in all the plans in your area, but they could be listed on different tiers with different copay amounts.

Part D Copay Tiers

Phases of Part D Prescription Costs

Prescription drug costs may change throughout the year depending on which phase of Part D coverage you are in. There are four phases of Part D coverage:

- Deductible Period: During this time, you will pay the full negotiated price of your drugs until you meet your Part D deductible. After you have met your deductible, your plan will begin to cover the cost of your drugs.

- Initial Coverage Period: This period occurs after you have met your deductible and your plan begins to cover your drug costs. During this period, your plan will cover some of the drug cost and you will pay your copayment or coinsurance. Each plan will define the amount of time that you will remain in the initial coverage period.

- Coverage Gap or Donut Hole: The coverage gap begins after you have reached $4,130 in total drug costs. More on the coverage gap in the sections below. If you exceed the spending threshold in the Initial Coverage Period, you will enter what used to be called the Part D coverage gap/"donut hole." While this gap officially “closed” in 2020, you are still responsible for paying 25% of the costs of your generic and brand name drugs in this phase.

- Catastrophic Coverage: This period begins after you have paid $6,550 in out-of-pocket costs in 2021. This amount is based on how much you spend on prescription drugs, not how much your plan also pays towards your prescription drugs or total drug costs (see more detailed information below in "What counts as my "true" out-of-pocket costs?")

Each plan will encourage you to use the lowest-cost drug to treat your medical condition. A drug on a lower tier will cost less than a drug on a higher tier.

What is the coverage gap or formerly known as the "donut hole"?

The coverage gap is the point in your Part D benefit in which most Medicare Part D plans stop paying for your drugs. You are in the coverage gap once your deductible period and your initial coverage period end, but you have not entered catastrophic coverage.

- The 2021 coverage gap discounts include 25% on generics and 25% on brand name drugs. The coverage gap begins when your total drug costs (what you and your plan pay) reaches $4,130.

- If you think your total drug costs may be higher than $4,130 per year, you may want to consider a plan that will help pay for your medications during the coverage gap. There are a small number of Part D plans that will pay for your generic and/or brand name drugs during the coverage gap.

When does the coverage gap end (catastrophic coverage)?

In Part D, you and the plan you join share the cost of drugs. The money that you spend is called your out-of-pocket costs. That determines if and when the catastrophic coverage begins. In 2021, the catastrophic coverage starts when you have paid $6,550 out-of-pocket.

- Once you have spent $6,550 for drugs in 2021, you would then pay 5% or less of the cost of your drugs for the rest of the calendar year.

- There is no cap or limit on the amount of drugs you can obtain after you have spent $6,550 out-of-pocket.

Your drug plan will keep track of your out-of-pocket drug costs. They will send you a report each month you purchase drugs.

Medicare divides drug costs into two different groups:

- Your "true" out-of-pocket costs: These are drug costs that count toward the start of your catastrophic coverage. In 2020, this includes the 50% discount amount the drug manufacturer pays for brand name drugs while you are in the coverage gap.

- All other drugs you bought that do not count toward your catastrophic coverage.

What counts as my "true" out-of-pocket costs?

Money that you paid for covered drugs. This includes your copays and drugs you paid for to meet your deductible. It also includes most of the amount (the 50% discount) that the drug manufacturer pays for brand name drugs while you are in the coverage gap.

What does not count toward my share of the costs?

- The premium for your drug plans (Medicare Part D plan or Medicare Advantage Prescription Drug plan)

- Drugs you bought that are not on your plan's drug list (formulary). Note: If you and your doctor get your plan to approve a drug not on the plan's drug list, then the costs for that drug do not count toward your share of the costs and catastrophic coverage.

- The discounts during the coverage gap that are paid by the plan, meaning the 56% discount on generics and the 15% discount on brand name drugs

- Costs that third parties - such as employers and union insurance plans - paid for you

- Drugs you bought that Medicare does not cover

- Drugs you bought from a pharmacy that was not in your plan's network

- Over-the-counter drugs